Personalizing guidance for 13M+ members

USAA served 13 million members across insurance, banking, and investment products, but each business line operated in silos. Members faced dozens of competing calls-to-action with no clear guidance about what mattered for their situation. I led the Next Best Action initiative, facilitating cross-functional workshops and designing a personalized recommendation system that increased product adoption by 28% and improved member satisfaction scores by 15 points.

Company

USAA

Year

2020

Role

Lead Product Designer

Timeline

2 months

01 CHALLENGE

Fragmented experiences, missed opportunities

USAA served 13 million military members and their families across insurance, banking, investments, and retirement products. The breadth created confusion. Members logged in and faced dozens of competing calls-to-action. Should they review their auto insurance? Open a savings account? Start a retirement plan? The app didn't guide them. It just offered everything at once.

Internal teams operated in silos. Each line of business pushed its own priorities without coordination. Members experienced this fragmentation as noise. They wanted clear guidance about what to do next based on their actual financial situation. Instead, they got generic marketing messages that felt irrelevant.

The business knew this was costing them. Member satisfaction scores showed people felt overwhelmed. Product adoption lagged because people couldn't find what they needed when they needed it.

02 RESEARCH

Aligning teams around member needs

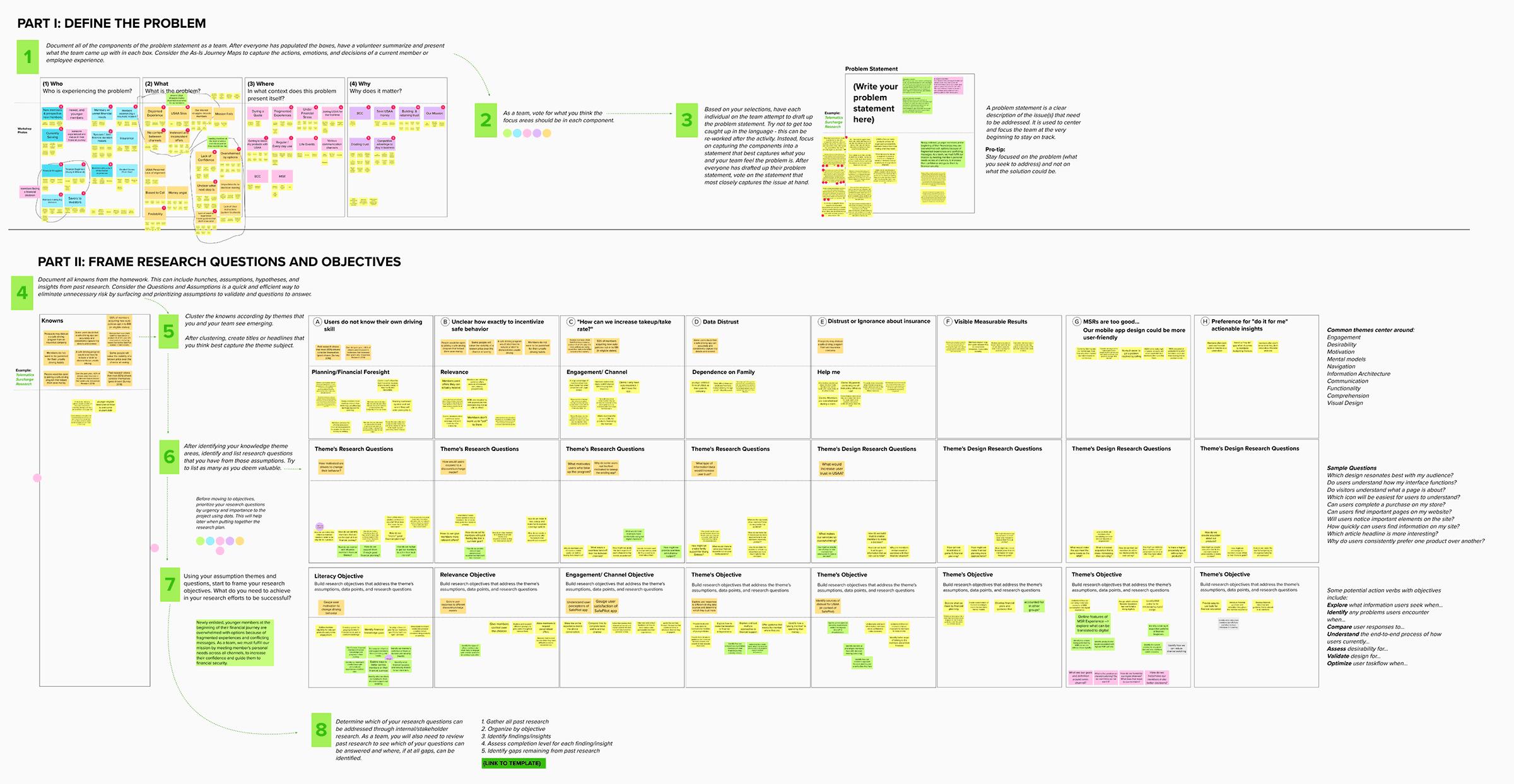

I started by bringing stakeholders together. I facilitated workshops with product owners from banking, insurance, investments, and retirement services. The goal was simple: stop talking past each other and define what members actually needed.

These sessions revealed the core problem. Each team optimized for their own metrics without considering the member's complete financial picture. Someone shopping for auto insurance might actually need life insurance first. But the systems didn't talk to each other, so members never got that guidance.

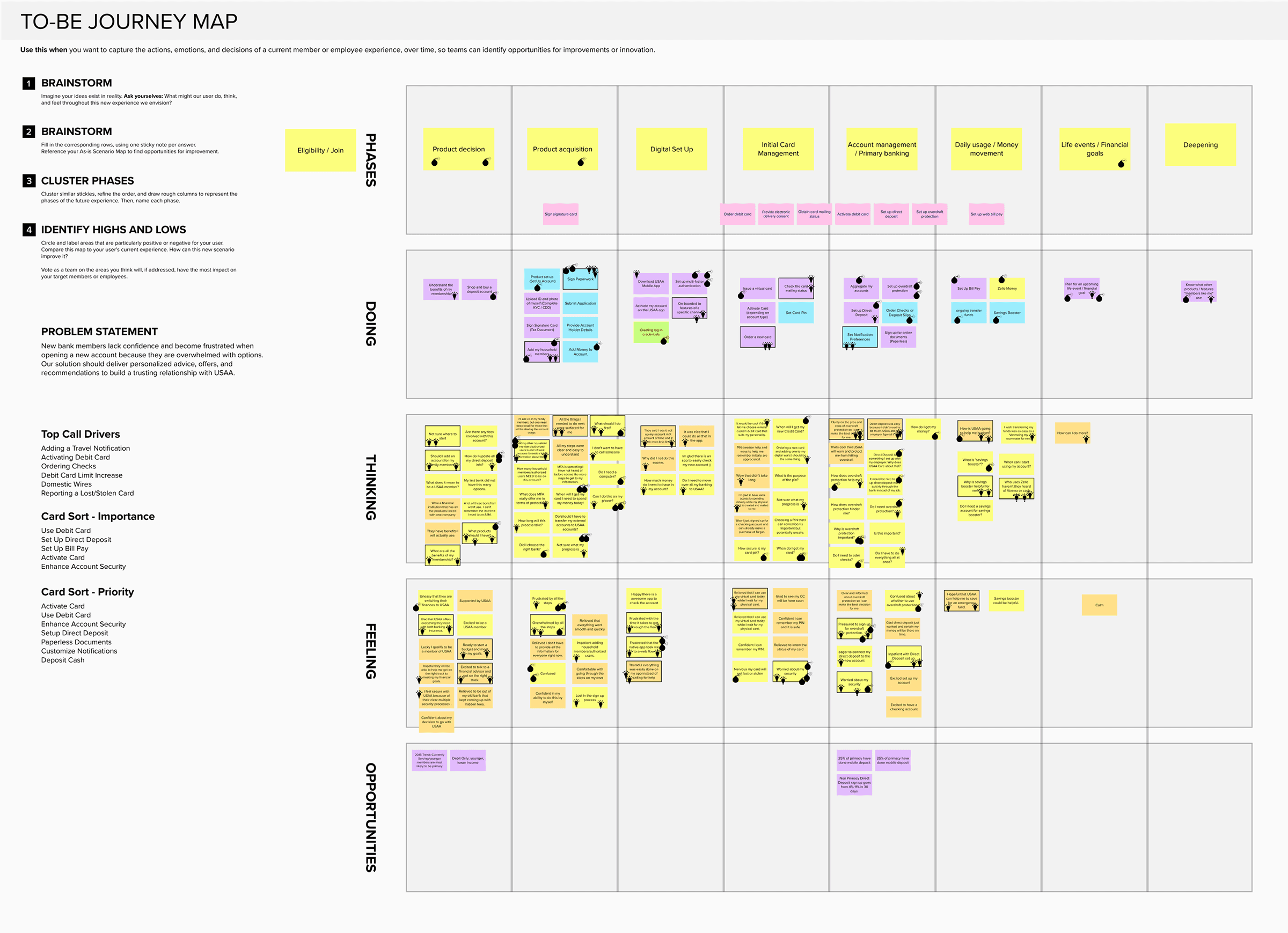

I worked with the research team to build member personas that reflected real financial situations, not just demographics. We created journey maps showing how members moved through major life events—getting married, having kids, buying a home, retiring. These journeys revealed natural moments for personalized recommendations.

The research showed us where members struggled most: transitions. Someone separating from military service faced dozens of financial decisions at once. New parents worried about life insurance and college savings. Our job was to meet them in those moments with clear, relevant guidance.

03 SOLUTION

A system that feels helpful, not pushy

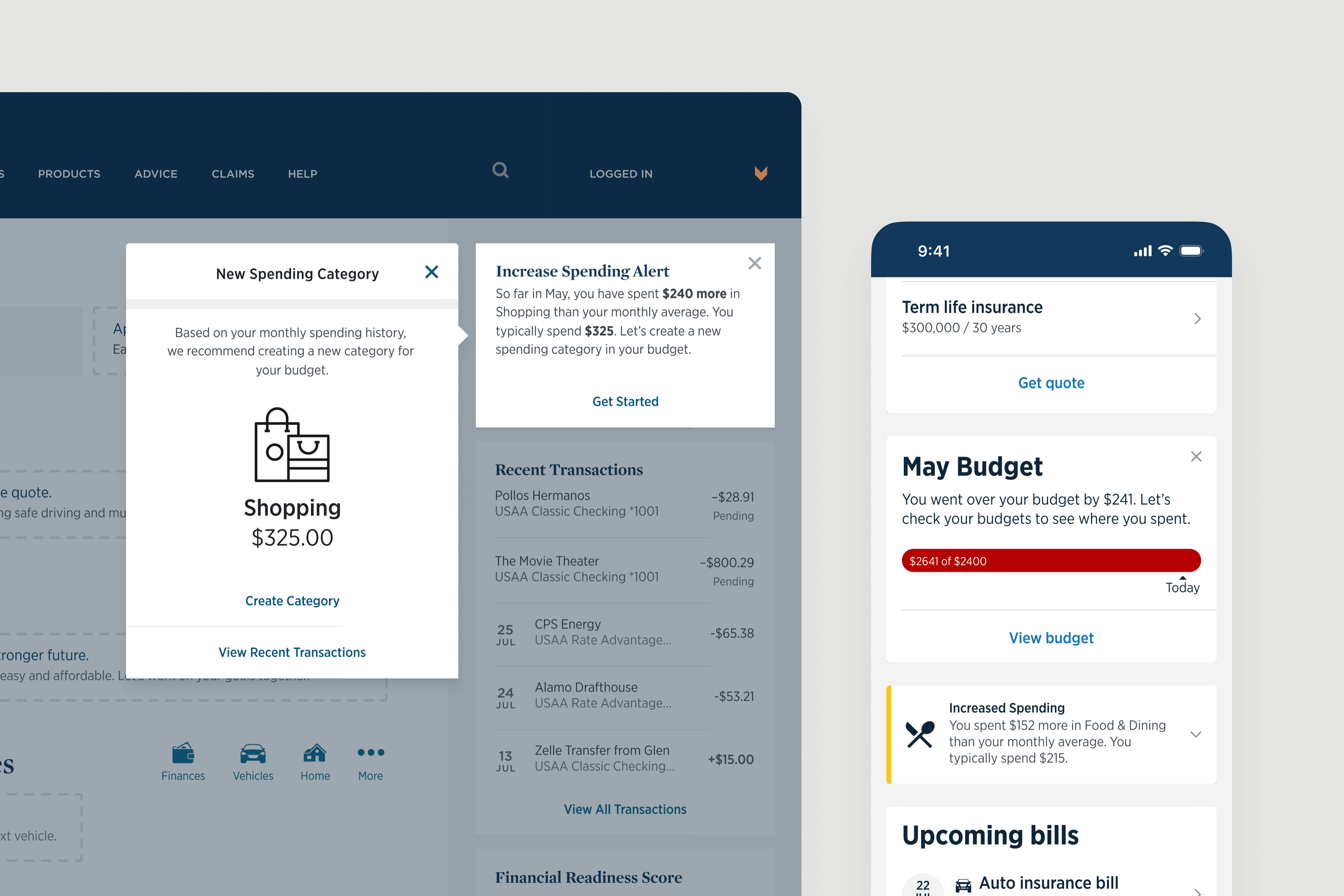

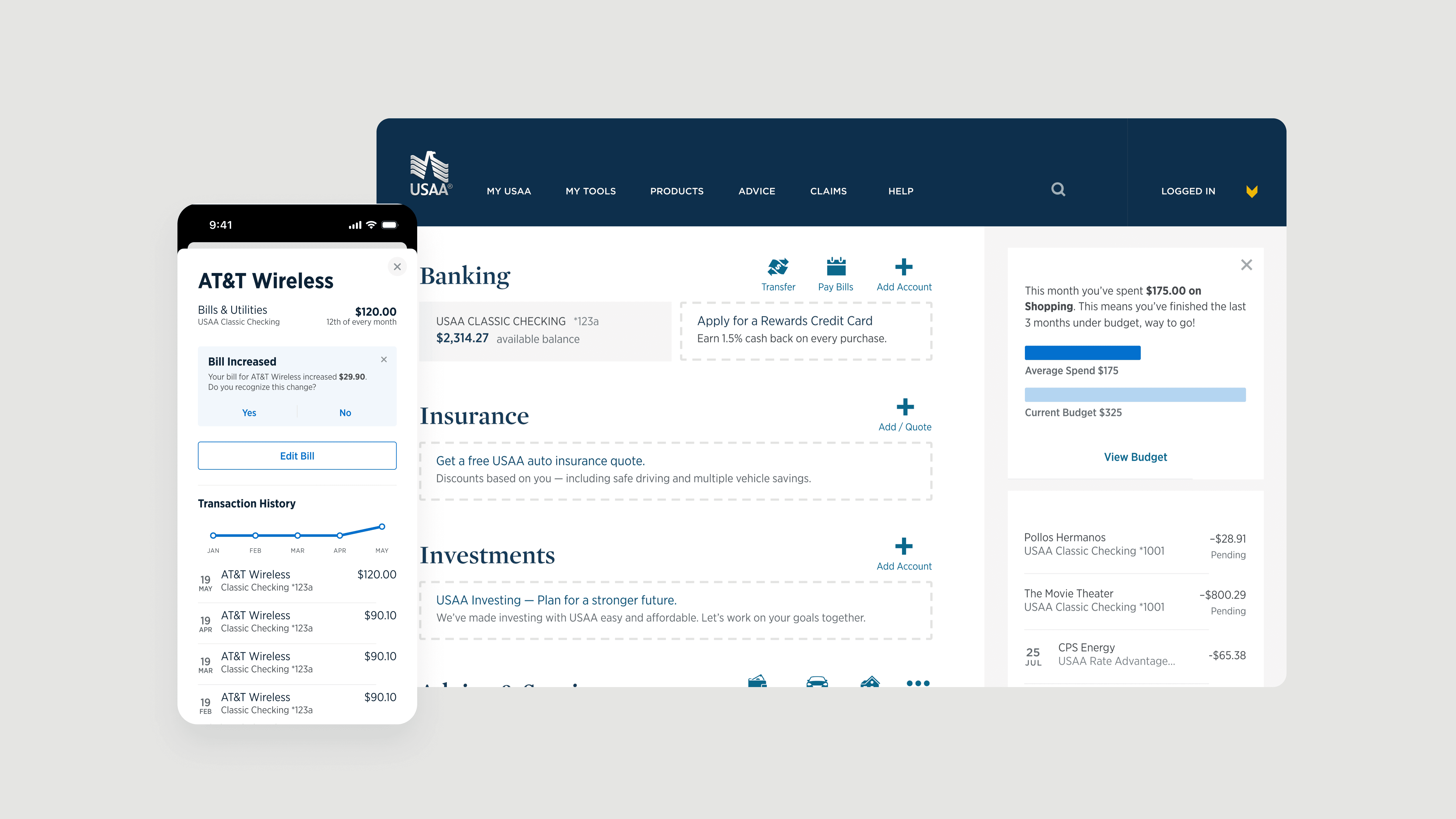

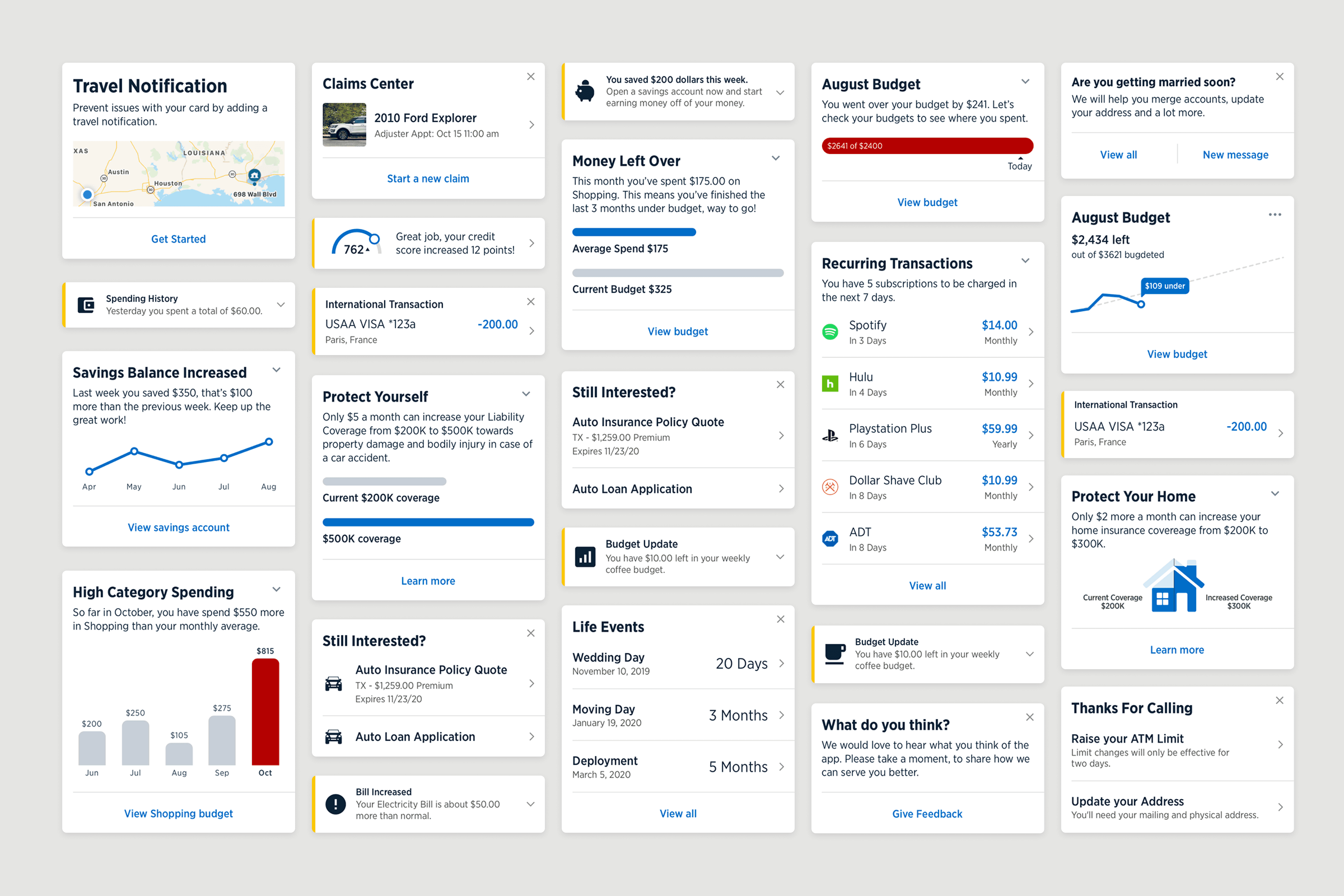

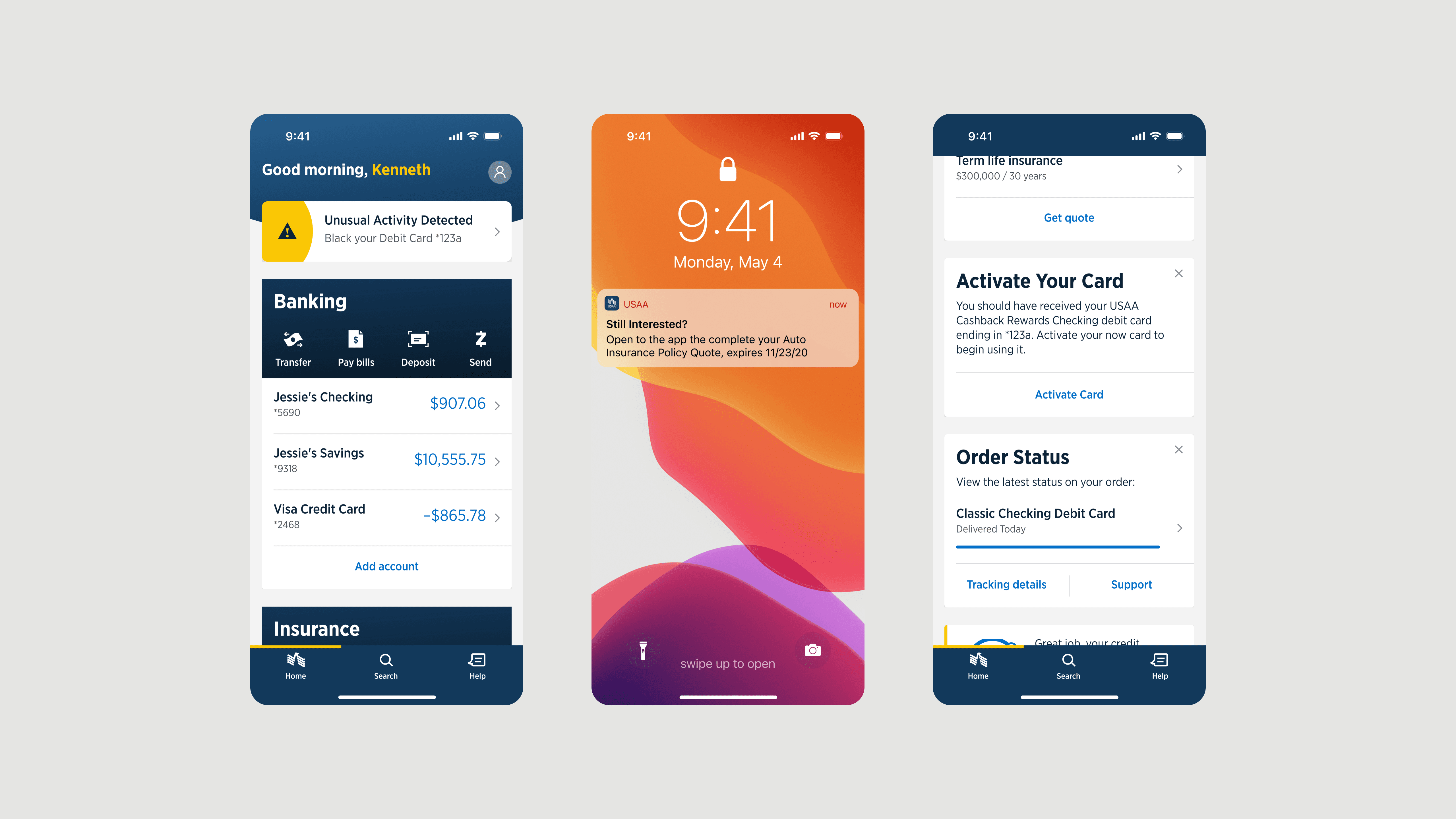

I designed a recommendation framework that prioritized member needs over business priorities. The system analyzed each member's financial profile, life stage, and behavior to surface the most relevant next action.

Data-Driven Framework

Working with data science, I created a framework that mapped member signals to specific actions. When someone's AT&T wireless bill increased by $30, we could surface a budgeting tool. When someone reported fraudulent activity, we could proactively suggest a credit freeze. Life events like deployment or retirement triggered contextual guidance specific to military life.

Transparent Communication

Every recommendation included a clear explanation of why it appeared. "We noticed your AT&T Wireless bill increased. Members in similar situations often review their budgets." This transparency built trust.

Scalable Pattern Library

I created a pattern library so the system could scale across insurance, banking, and investment products. Same structure, same tone, different content. This let us move from concept to production quickly while maintaining consistency and compliance.

04 impact

Improved engagement and satisfaction

The Next Best Action initiative delivered measurable impact across the member base. Product adoption rates increased 28% for recommended services. Member satisfaction scores improved by 15 points. Support calls about product selection dropped 34%.

The recommendation framework scaled across insurance, banking, and investment products, creating a consistent experience for 13 million members. The personalization approach became USAA's standard for new feature development.

Most importantly, members got clear guidance when they needed it. The system helped people make confident financial decisions without overwhelming them with options.

05 REFLECTION

Alignment before execution

Biggest lesson: the hardest design problems aren't visual, they're organizational. Getting banking, insurance, and investment teams to coordinate required building shared language, demonstrating value through prototypes, and showing how personalization served both members and business goals.

The workshop approach worked because it forced teams to solve problems together instead of defending territory. Once everyone agreed on the framework, execution moved fast. Strategic design work succeeds when you can get diverse stakeholders rowing in the same direction.